What are the costs of owning a home?

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict , this post may contain references to products from our partners. Here's an explanation for .

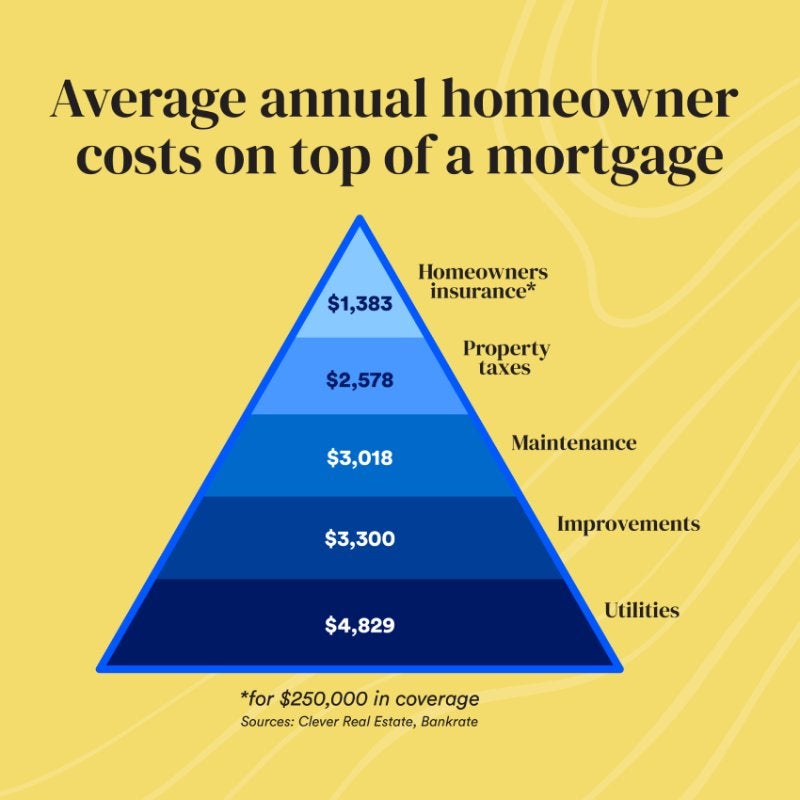

Your house isn’t just one of the biggest purchases you’ll likely make; there are ongoing expenses that come with homeownership, as well. You know about your mortgage payments, of course. But in addition to that, there are ongoing costs of maintenance and upkeep. And some of these can be hidden costs—that is, less obvious to the naked eye and not necessarily encountered in everyday life.

The most common home maintenance expenses

One of the biggest costs of owning a home is maintenance and routine upkeep. Maintenance includes some obvious and not so obvious things.

Obvious home maintenance costs

- Lawn care, including mowing and watering

- Keeping exterior paint fresh, siding in good condition

- Keeping the home clean

Hidden home maintenance costs

- Pest prevention

- Clearing rain gutters

- Replacing smoke alarm batteries

- Roof repair

Roof Repair/Replacement

Keeping your roof in good shape, and eventually replacing it, is one of the more expensive maintenance costs that you’ll incur on your house — but it’s also one of the most vital. In many cases, a roof can be expected to last 20 years (if kept in good condition), but some roofing materials like copper and tile can last up to 50 years.

Within a range of $5,609 and $11,845, the average cost of roof replacement is $8,688, HomeAdvisor reports, with about 60% of the cost coming from labor — though of course it’ll vary depending on on the size and slope of your roof, and the materials you use.

HVAC, wiring, plumbing systems

You’ll also want to consider the cost of maintaining systems like your heating, ventilation and air conditioning (HVAC). According to HomeAdvisor, having your air conditioning serviced can cost between $75 to $200, and hiring a technician for a repair can run you $50 to $150 per hour.

At some point, you might also need to check for wiring and plumbing issues to make sure those systems are still in good shape. Having any issues addressed or older systems upgraded will likely require a professional, which also comes at a cost. The average cost of a wiring project is about $2,000, according to Home Guide, while single fixture plumbing issues can range from $600 to $1,600, per Angi.

Other ongoing home maintenance expenses

Homeowners Association (HOA) fees

If you live in a homeowners association (HOA), you’ll likely need to pay HOA fees, which could be charged monthly, quarterly or annually. Depending on where you live and the association, HOA fees can amount to thousands of dollars per year, and may include some maintenance, such as snow removal and lawn care, or you may have to pay extra for those services. You can check with the association to find out what fees you’re required to pay and which are optional add-ons.

Homeowners insurance

As you add up the cost of owning a home, don’t forget to include homeowners insurance. Homeowners insurance coverage and premiums vary widely, so it’s important to shop around and compare offers. Generally speaking, if you want to save money on premiums, you can increase your deductible.

Most mortgage lenders require that you carry a certain amount of homeowners insurance to protect the value of the home, but the policy also protects you. When a covered event happens, you can rely on the insurance payout to help you make repairs rather than paying the whole cost out of pocket.

Property taxes

For many homeowners, there’s a good chance they’ll live in an area where they’ll need to pay property taxes. Property taxes are determined by your city or county’s effective tax rate and your home’s value, which may be evaluated based on fair market value in the area or by the home’s individually assessed worth. Depending on your city or county, you might pay each month, or you might end up with a bill every year or twice a year.

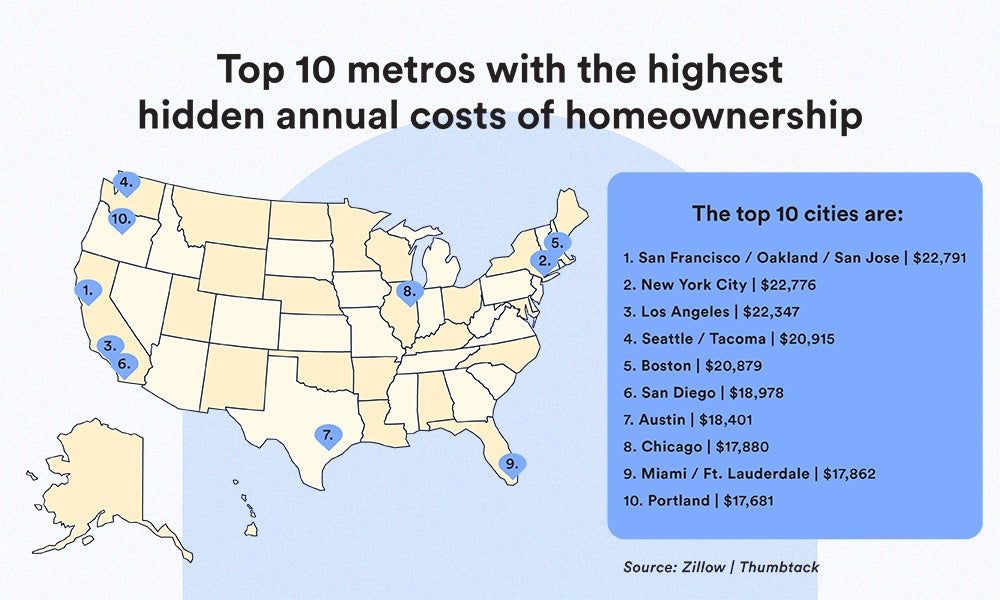

Where are homeownership costs the highest?

Overall, the various hidden costs of homeownership add up to approximately $15,000 per year. But that’s a national average. The sum can vary by thousands of dollars depending on where you live, as a new study from real estate listings site Zillow and home renovation platform Thumbtack indicates: topping $20,000 annually in major East and West Coasts burgs, hovering around $10,000 in Midwestern cities or smaller towns. Not surprisingly, the more affordable a city’s real estate residential prices are, the more affordable the maintenance costs tend to be.

Repairs vs maintenance

Unlike maintenance expenses, a home repair can be the result of a natural disaster or a major failure of a system. Depending on the situation, you might be able to get help from your homeowners insurance policy — but if a major issue, such as a termite infestation or a tree branch falling on your roof, requires repair, that can cost you significantly.

Other issues, like flooding or water damage, can erode a home’s foundation and require significant repair. A January 2022 survey by James Hardie Industries found that nearly 50% of homeowners report needing to make major repairs as a result of extreme weather events, which can often do lots of damage to yards and exteriors of homes.

How to budget for homeownership costs

Once you have a handle on the full costs of owning a home, creating a budget is key. For some costs, like homeowners insurance, HOA fees and property taxes, you might be able to include a regular line item in your budget and plan for it each month. If you have a mortgage, you’ll likely be able to include them in that payment.

Figuring out ongoing maintenance costs and future repairs can be a little trickier. One suggestion, provided by American Family Insurance, is to set aside about 1 percent of your home’s value each year for maintenance and repairs; other insurers, such as State Farm, recommend up to 4 percent.

For example, if your home’s value is $375,000, the current average home value in America, you’d want to budget about $3,750 per year. You could break that down into a monthly budget item of $312.50, and keep the money in a high-yield savings account until it’s needed.

Gauging your budget for repairs may be more challenging. If you’re buying a fixer-upper, a home inspection report can provide you with an idea of how much to budget for repairs and upgrades.

You can also build an emergency fund to help you pay for home repairs and maintenance — many people find that having a separate savings account for the unexpected costs of owning a home can be helpful.

Related Articles